3/9/2012

Bangkok Post

As business opportunities open wider ahead of

the launch of the Asean Economic Community (AEC) in 2015, the four

less-developed economies, often referred to as CLMV (Cambodia, Laos,

Myanmar and Vietnam) are among the most attractive for Thai investors.

At the onset of the journey for Thai companies looking to extend or relocate production to these neighbouring countries, awareness of the local financial services environment is critical to making the right business decision. Three important issues need to be explored: What is the landscape of CLMV banking industry? How convenient are fund transfers and foreign exchange? What kinds of services can Thai banks provide for investors in CLMV markets?

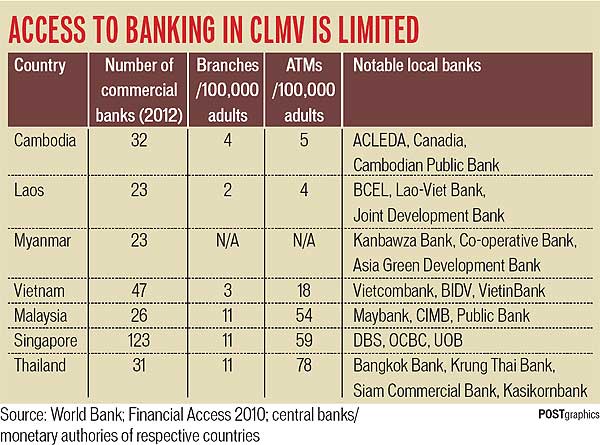

First, banking access in the CLMV markets is rather limited, which reflects the predominantly cash-based environment. Banking facilities are limited both in scale and in scope, even though the numbers of commercial banks are comparable to those in Thailand and Malaysia. There are fewer than four physical branches per 100,000 adults in CLMV, compared with 11 in Thailand, Malaysia and Singapore.

The disparity between CLMV and the three more developed economies is even more stark in terms of access to ATMs. The number of automated teller machines in Laos and Cambodia is around 15 to 18 times lower than in Thailand, even when adjusted for population size. In addition, the first ATM in Myanmar was only introduced to the public in Yangon in November last year.

The usage of cheques is not widespread either. In Myanmar, investors may have difficulty cashing a cheque from a different bank since no interbank cheque-clearing system exists. It is therefore typical to see most transactions in CLMV carried out in cash.

Services offered by domestic banks in CLMV remain pretty basic savings and lending products. Commercial banks’ lending rates in CLMV are fairly high compared to those offered in Thailand. This partly results from relatively high inflation and credit risk.

Banking reform is likely to be the next hot topic in CLMV to cater for growth and emerging business requirements. The banking system in Myanmar needs major reform to establish international business services and links to global financial systems. Meanwhile, the banking system in Vietnam needs restructuring given that many banks are in perilous financial condition with sizable non-performing loans and depleting deposit bases.

Laos, on the other hand, has a very high interest rate spread which reflects the inefficiency of the financial system. This situation, if it persists, could discourage potential savers and impede credit extension.

Secondly, regulations governing fund transfers are now much more relaxed than before.

Foreign-exchange operations, except for Myanmar’s, are generally liberalised. Cambodia has no restriction on purchase and sale of foreign currencies. In fact, Cambodia is a dollarised economy with more than 80% of business transactions in US dollars, including deposits and lending. While Laos law does not encourage payment for goods and services in foreign currency, in practice the Thai baht and US dollar are preferred for import transactions.

In Myanmar, the US dollar is readily accepted at shops and is the main currency for international trade, along with the euro, Singapore dollar, and yen.

Despite Thailand being the second largest trading partner with Myanmar after China, there is still no direct baht quote for the kyat.

As these emerging economies are prone to inflation and some often experience a balance-of-payments deficit, their local currencies tend to fluctuate more. The Vietnamese dong, for example, has lost 30% in value since the end of 2006, with dong devaluation by the State Bank of more than 9% in 2011 alone.

Myanmar, meanwhile, has finally abandoned the former junta’s artificial peg, which created a massive disparity between the official and black-market.

Finally, the open atmosphere of the banking businesses in Cambodia, Laos and Vietnam allows for healthy participation by Thai banks, along with other foreign commercial banks. Their main purposes are often to serve corporate customers from home countries who are investing in CLMV through foreign branches, but some have gone as far as setting up subsidiaries to serve local customers.

In terms of coverage, Thailand’s biggest banks have a relatively better presence in CLMV than those from Malaysia and Singapore, thanks to the long-standing border trade and foreign investment from Thailand in these countries.

With the strong presence of Thai banks, the relatively lower lending rate in Thailand, and ease of regulations on fund transfers on both sides, it is prudent to have funding arrangements in Thailand and channel these funds through the network of Thai commercial banks in these countries. Branches of Thai commercial banks are able to offer what businesses normally require in international trade transactions, including payments and foreign exchange, trade loans and the issuance of letters of credit (L/C).

Although the market has not opened for foreign bank participation, banking in Myanmar is changing fast. At least four Thai banks are either in operation or have been granted licences to set up representative offices. Authorities expressed their intention to allow foreign banks to set up joint ventures by 2014 and to open full banking operations by 2015.

Under the AEC, central banks across Asean countries are working together to drive financial service integration to support intra-regional trading and investment activities. While full financial liberalisation under the AEC is not due until 2020, progress in some areas has been made. Authorities are negotiating the common standard for a Qualified Asean Bank which will allow designated banks to conduct businesses in every Asean member country. Payment system standards and integration are also being reviewed.

In the meantime, the network of Thai banks in the region will facilitate the flow of goods and services through the regional supply chain, which will become increasingly relevant in the AEC era.

EIC, a unit of Siam Commercial Bank Public Company Limited, offers in-depth macroeconomic outlook and sectoral impact analyses. For more information, please visit www.scbeic.com or contact eic@scb.co.th

No comments:

Post a Comment