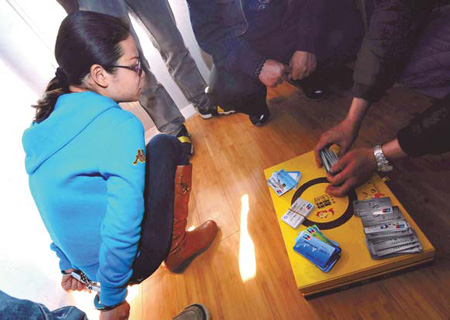

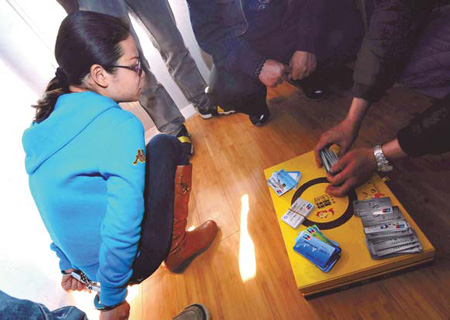

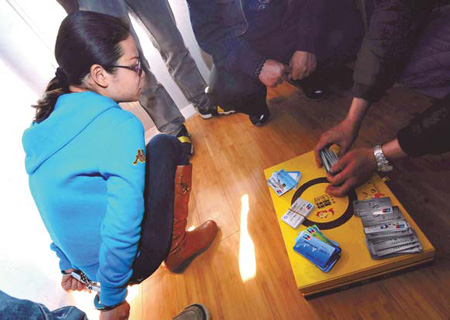

Police arrest a telecom scam suspect and seize a large number of credit cards in Nanning, the Guangxi Zhuang autonomous region, on Dec 27, 2010. He Yun / for China Daily

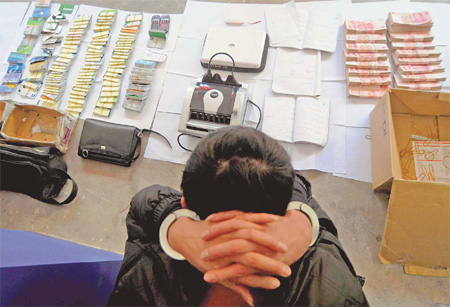

|  A suspect is held and displayed with evidence of a telecom scam last year in Nanning, capital of South China's Guangxi Zhuang autonomous region. Police knocked out nine operations sites. He Yun / for China Daily |

|  The immigration department of Cambodia holds suspects in a telecom fraud in Phnom Penh, the capital. They are among the 598 people who were arrested in the scam after an investigation led by police from the Chinese mainland and in Taiwan. Provided to China Daily |

By Zhang Yan and Yang Wanli (China Daily)

Updated: 2011-06-22

Flaws in telecom operations and lax banking security make it harder for police to bust scams, Zhang Yan and Yang Wanli report in Beijing.

Have you ever received a call or a text message telling you that your credit card was stolen and your personal information is needed for verification? Or that you are a lottery winner and have to wire some tax money to a bank account?

If yes, you may have been the target of a telephone scam, a crime that is becoming increasingly rampant.

Police on the Chinese mainland and in Taiwan recently busted the largest-ever telephone scam in the region with help from police in four Southeast Asian countries, the Ministry of Public Security announced on June 11.

The 598 people who were arrested are suspected of cheating their victims out of 70 million yuan ($10.8 million).

In exclusive interviews with China Daily, senior police officers described how the massive scam worked.

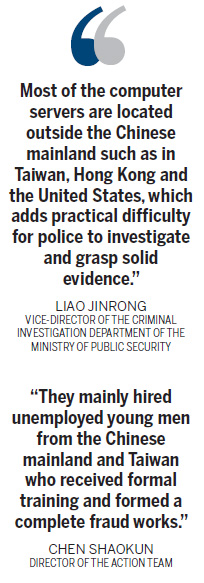

According to Liao Jinrong, vice-director of the ministry's criminal investigation department, difficulty in obtaining evidence and flaws in telecom and banking operations are the greatest obstacles Chinese police face in shutting down cross-border telecom fraud.

"Most of the computer servers are located outside the Chinese mainland such as in Taiwan, Hong Kong and the United States, which adds practical difficulty for police to investigate and grasp solid evidence," Liao said on Monday.

Moreover, the telecom companies allowed the crooks to make thousands of overseas phone calls to the mainland using altered numbers. The companies can detect when the "from" phone number is phony, and Liao said they should have done something about it.

There are also flaws in the banking system, he said. "Usually the suspects used IDs that they borrowed, stole or picked up off the street to apply for bank cards, and the banks didn't carefully examine them at all."

"In every large-scale telecom fraud case, hundreds of bank cards are seized, covering nearly all Chinese regions and all kinds of commercial banks."

Well-organized crooks

The conmen here are organized professionals. According to Chen Shaokun, director of the action team that was formed to combat this case, a telecom scam is usually committed by an organized group and in a professional manner, with different divisions of the group assuming different tasks to swindle the victims.

In this case, authorities said, the operation included 186 people from the Chinese mainland, 410 from Taiwan, one from Cambodia and one from Vietnam. Police across the Straits, working with their counterparts in Cambodia, Indonesia, Malaysia and Thailand, destroyed 106 calling centers that were bases for the operation.

The investigation started in December, when a number of telecom-based swindles were reported on the mainland and in Taiwan. Police across the Straits began to work together.

They found out that the manipulators were based in Taiwan and others were divided into several major groups, including phone calls, network maintenance, and specialists in withdrawing, transferring and laundering money, Chen said on Monday.

The bosses bought or rented computer servers and programs to set up the host computer and circuits in Taiwan, which made it possible to place calls using altered numbers, to dial groups of numbers on the mainland and to answer return calls, he said.

Calling bases were scattered in Taiwan, Cambodia, Indonesia, South China's Guangdong province and East China's Fujian province, and each was staffed with 10 to 40 people.

"They mainly hired unemployed young men from the Chinese mainland and Taiwan who received formal training and formed a complete fraud works," he said.

From February to June, they made 850,000 calls to mainland phone customers, according to figures provided by the ministry.

"Many of them pretended to be the police or court officers calling to tell the victims they had been involved with a money laundering case or other economic cases, and their private information had been disclosed. Then they were told their accounts were unsafe, and they had to transfer their money to a new, designated account," Chen said.

Other tricks included informing victims they had won a prize or owed money for phone bills, and scams involving credit cards, online shopping, long-lost friends, even kidnapping and extortion.

After the victims transferred their money to the accounts specified by the crooks, Chen said, the laundering groups soon split up and transferred the money to hundreds of bank cards, loading each with as much as 20,000 yuan. Then, they withdrew the money from ATMs at various places overseas to escape notice by police.

Women at risk

Most victims in telecom frauds are senior women or housewives. Fraud calls are generally made on weekdays from 10 am to 2 pm, when the victims are at home alone.

Haidian district court in Beijing heard a criminal case in early April involving a resident who was cheated out of more than 10 million yuan (about $1.5 million) by telecom fraud in October 2009.

The victim, whose surname is Zhang, said she received a call on Oct 22, 2009, saying that her landline phone account was overdue 2,600 yuan. The caller rerouted the call to "police in Huairou district" for Zhang. She said the "police" asked for her personal information and told her that her bank account had been involved in a fraud case.

"Several days later, a man who claimed to be the chief justice of Huairou district asked me to transfer my money into a new account for safety concerns," she said.

"After I followed his instruction, I lost any contact with him."

A 37-year-old man from Taiwan, Lu Jian-ren, was later held to be responsible for the case. He was sentenced to eight years in jail and fined 8,000 yuan.

In most such cases, crooks usually persuade victims to transfer their money to a new account and they will withdraw the money within 15 minutes, Chen said. The money will soon go to the underground market and is hard to get back, especially in cross-border cases.

Heavy penalties

Suspects who are accused of publishing false information to swindle others - by sending messages or using the Internet, radio, TV, newspapers or magazines - will be charged with fraud and will be subject to heavier penalties, said Hong Daode, a professor in the Criminal Justice College at China University of Political Science and Law.

Such penalties also are levied if someone is held criminally accountable for sending 5,000 or more fraudulent text messages, making 500 or more fraudulent phone calls or using excessive tactics.

Under the Criminal Law, a person convicted of common fraud may be jailed for up to three years. If the amount of money involved is 30,000 to 100,000 yuan, the sentence can range from three to 10 years.

A sentence of 10 years to life is possible if the circumstances of the case are serious, such as the amount of money involved is more than 500,000 yuan, or the fraud results in someone's death or the victim's loss of sanity.

Moreover, people who provide criminals credit cards, mobile phone cards, communication tools and network technology that support or assist in the crimes can be held criminally accountable and charged with fraud, according to the regulations.

Li Jiabao contributed to this report.

(China Daily 06/22/2011 page1)

No comments:

Post a Comment